fidelity tax free bond fund by state 2020

Data delayed at least. Read Up On What Affects The Municipal Market With Resources From PIMCO.

Best Mutual Funds Awards 2020 Best Muncipal Bond Funds Investor S Business Daily

Ad Navigate A Changing Municipal Bond Market With PIMCOs Expert Insights.

. Fidelity Tax-Free Bond Fund. The expense ratio is 025. This guide may help you avoid regret from making certain financial decisions.

Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal. Maka joined Fidelity in 2000 and had. 1 Year change -355.

QUARTERLY FUND REVIEW AS OF DECEMBER 31 2021 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds. The roster in March 2020.

L Fidelity Municipal Income Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve. The minimum initial investment is 25000. All Classes Various 661 Fidelity Corporate Bond Fund FCBFX 212 Fidelity Emerging Markets Debt Central Fund FEMAF 147 Fidelity.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Fidelity Tax-Free Bond FTABX. Muni Ohio portfolios invest at least 80 of assets in Ohio municipal debt and can include long- intermediate- and short-duration portfolios.

Fidelity also offers tax-free municipal bond funds that focus on states such as California New York and. Todays Change 001 009. Because the income from these.

The most important or decisive factors leading to the funds overall rating. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. Read Up On What Affects The Municipal Market With Resources From PIMCO.

Before investing consider the funds investment objectives risks charges and expenses. Ad Navigate A Changing Municipal Bond Market With PIMCOs Expert Insights. Fidelity Tax-Free Bond has found its stride.

Fidelity Conservative Income Bond Fund. As of January 21 2022 the fund has assets totaling almost 472 billion invested in 1363 different holdings. The amount of municipal bond interest from your state Puerto Rico the Virgin Islands and Guam can be calculated by multiplying the total interest dividend you received.

Ad Research a Variety of Municipal Bond Funds Available from Fidelity. View mutual fund news mutual fund market and mutual fund interest rates. FTABX A complete Fidelity Tax-Free Bond Fund mutual fund overview by MarketWatch.

Its portfolio consists of. Fidelity Tax-Free Bond Fund.

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

Share Buybacks Companies Buying Their Own Shares Fidelity Corporate Bonds Inflection Point Financial Engineering

Fidelity Money Market Funds How To Choose The Best One

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Etfs Again Proved Their Worth To Taxable Investors In 2020 Morningstar Portfolio Management Investors Bond Funds

7 Fidelity Index Funds To Ground Your Portfolio Fdvv Fltmx Fscsx Investorplace

Market Watch 2021 The Bond Market Fidelity

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

How Much Fidelity Bond Coverage Are We Required To Have

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Bond Funds Fund Management

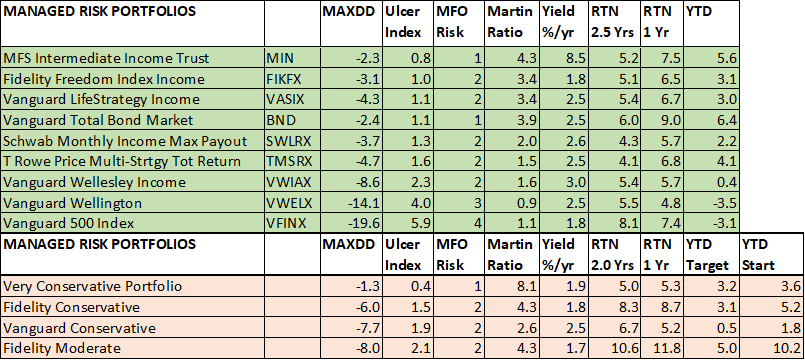

Mutual Fund Observer July 2020 Update Seeking Alpha

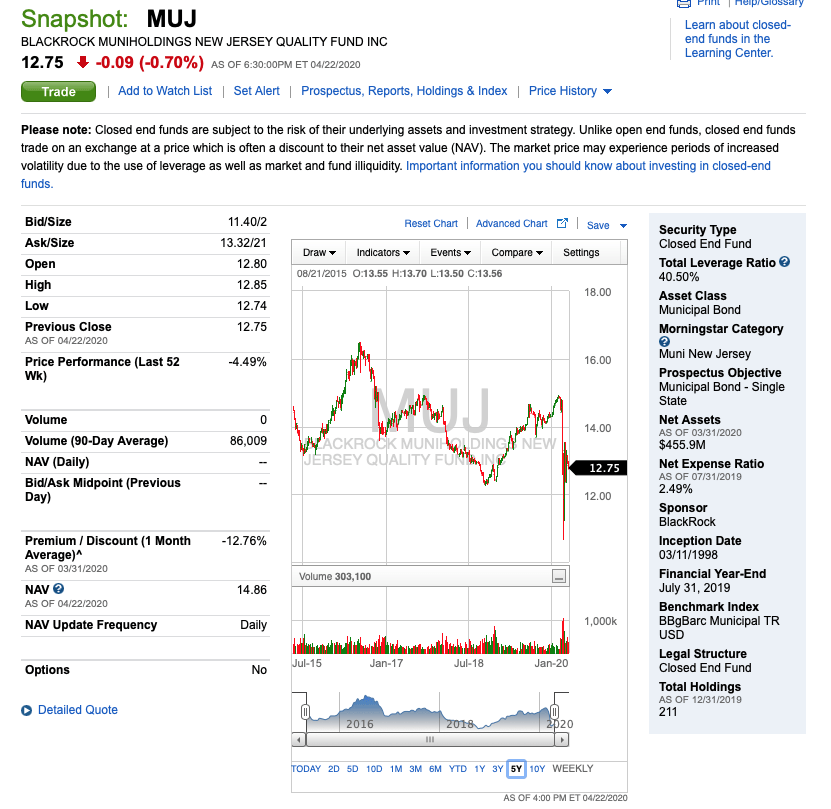

Blackrock Nj Cef 14 Discount To Nav And 7 25 Taxable Equivalent Yield Nyse Muj Seeking Alpha

Animal Spirits Bidding Wars How To Raise Money Spirit Animal Spirit